The US vehicle market is undergoing a significant shift, with

hybrid vehicles gaining momentum as the popularity of electric

vehicles (EVs) begins to slow.

Although electric vehicles are still gaining popularity in the

US market, the electric vehicle growth rate has slowed

significantly compared to previous years.

Slowdown in Electric Vehicle Growth

S&P Global Mobility new vehicle registration data indicates

that year-over-year EV growth through the first nine months of 2024

has plummeted 80% compared to the same period in 2023.

EVs accounted for 9% of new retail registrations in

January-September 2024, up just 0.6 percentage points from their

2023 market share. However, this increase is less than half the

rise in any of the prior three years.

Incentives and EV Demand

To spur EV retail demand, original equipment manufacturers are

significantly increasing incentives, with the average total spend

per unit reaching $12,527 in September, three times the $4,188

spent two years ago.*

Furthermore, migration data at the fuel-type level (see Table

#1) indicates that households with gasoline vehicles are now

marginally more likely to purchase an EV than they were a year ago.

However, the likelihood of households with hybrid or electric

vehicles purchasing another EV has declined year over year.

The Financial Appeal of Hybrid Vehicles

S&P Global Mobility new vehicle registration data, combined

with financial transaction data from TransUnion, point to hybrids'

value proposition relative to EVs as one influence on EV

demand.

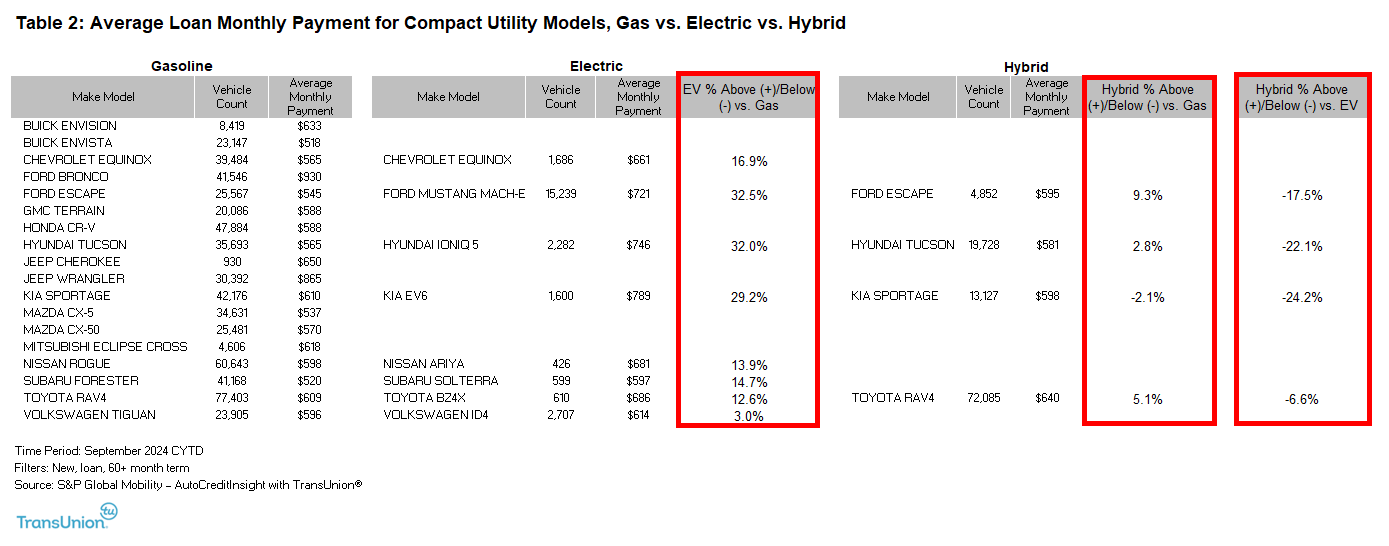

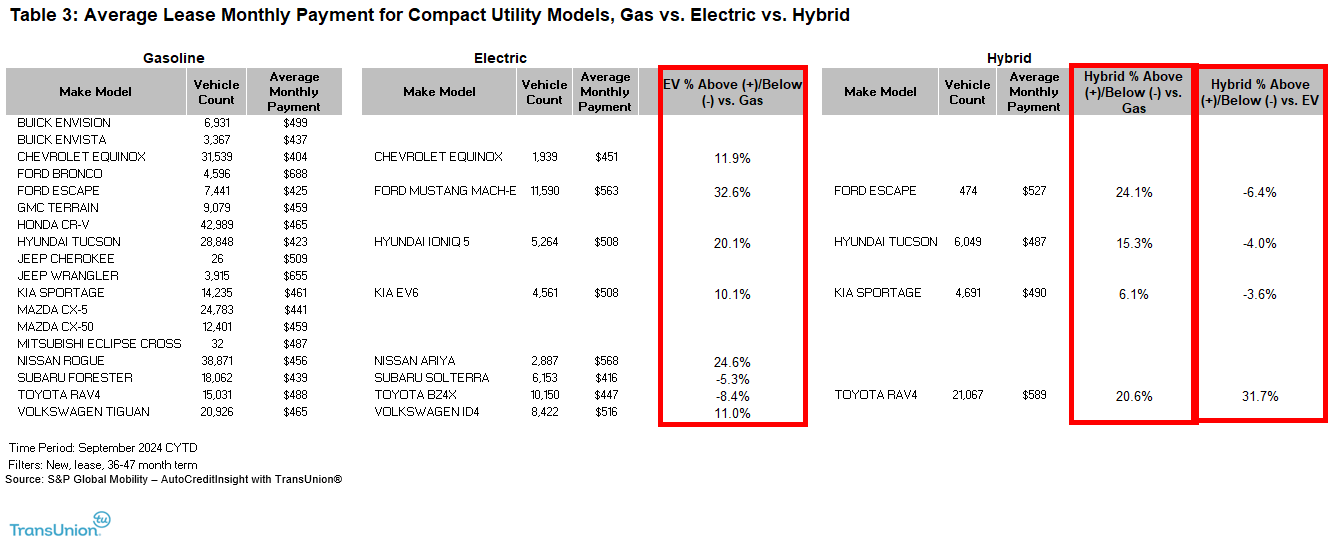

As Tables #2 and #3 demonstrate (one focuses on loan monthly

payments and the other on leases), the average monthly payment for

a hybrid is lower than the monthly payment for a similar EV in

seven of the eight scenarios in the Compact Utility Segment, the

largest segment in the industry.

The one exception is when a RAV4 hybrid is leased; here the

hybrid payment is higher than the gasoline version and the EV

payment is lower.

Hybrids' Success in the Market

The financial advantages of hybrids compared to their gasoline

counterparts, as illustrated in the prior tables, are a key factor

for their recent success in the US market. Hybrids' impressive

market performance includes:

- Retail US market share reached a record 14% in September, up

3.0 percentage points in one year and almost 1.5 points in just

August-September 2024. - Almost half of market leader Toyota's retail registrations in

September were hybrids, a far higher mix than for any other

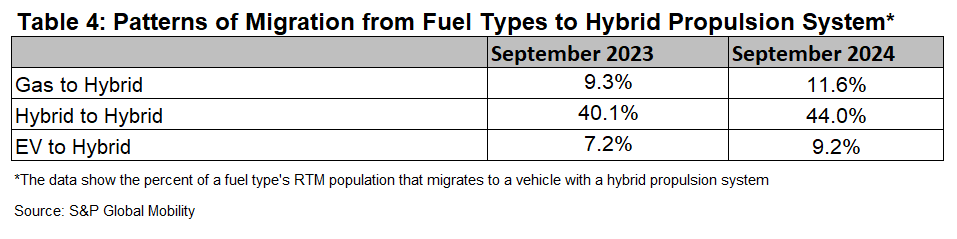

brand. - September 2024 hybrid loyalty (of the return-to-market hybrid

households in September that acquired a new vehicle, what percent

acquired another hybrid) reached a near-record 44%, second only to

February's 44.3% result. - Migration from all three major fuel types to the hybrid

propulsion system has increased from a year ago, as shown in Table

#4.

The Evolving US Vehicle Industry

The US new vehicle industry is more complex than ever, with over

400 models, 50 active brands, 34 segments, 3 fuel types and

numerous (sometimes conflicting) external influences including an

upcoming change in the federal administration. This landscape makes

it challenging to identify performance drivers, yet the data

addressed above indicates financial factors, such as monthly

payments, still play a role.

Demo Our Loyalty Analytics Tool

*Incentive data are from Autodata